Non-bank lending has become a phenomenon in the Australian property market. Although official statistics are hard to come by, anecdotal evidence suggests that private groups are lending Aussie companies and individuals billions of dollars each week.

What created this amazing trend in private lending, what does the non-bank lending landscape look like and where will the market go next? Delving into these questions will give you a good idea about the state of the Australian real estate market today.

Aus-China Non-Bank Lending Conference, 22 Sept 2016 | Westin, Grand Ballroom, Sydney Click here

NSW Strata Law Change -opportunities for site acquisitions from the 75% majority rule, when fairness meets fortunes,28 Sept 2016, Sydney Click here

How Did It All Start?

Non-bank lending has been going on in Australia for many years. Companies like Pepper and Resimac have taken over a huge chunk of the home mortgage market and Aussie Home Loans’ CEO John Symonds has for years been assuring Australians that “At Aussie, we’ll save you.”

In the commercial lending space, Development Finance Partners, MaxCap, Qualitas and Balmain Group have been underwriting property developments for a long time.

Things accelerated sharply, however, in July 2015 when the Australian Prudential Regulation Authority (APRA), aided by BIS Shrapnel and egged on by the RBA, significantly increased the capital requirements for Australian banks.

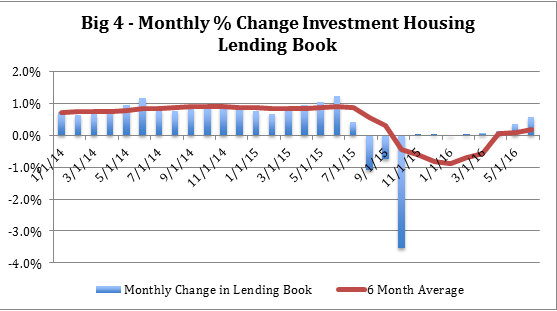

This, along with the Labor Party’s aggressive stance on negative gearing, and a scandal involving falsified loan documents at ANZ and Westpac, has resulted in a significant slowdown in property lending by Australia’s Big 4 banks:

Had the Big 4 continued to grow their investment housing lending book at the same average rate as they did the 12 months ended June 30, 2015, they would have lent an additional $68.4 billion into the market.

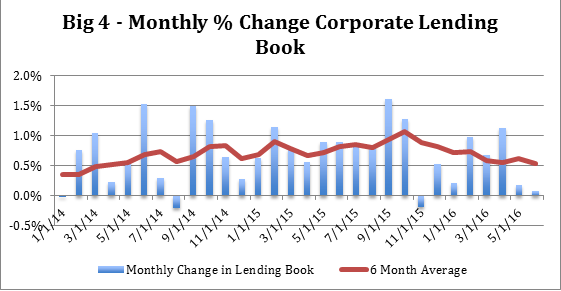

At the same time, the Big 4 have also begun to pull back on corporate lending, and while this trend is still emerging, it has added to the challenges faced by property buyers:

Faced with dramatically tougher lending requirements, Australian property developers, investors and buyers have been scrambling to fill this $68 billion gap.

Old Problems

The lending drought has given new urgency to the age-old financing problems faced by every property developer. Land banking, the first step in most property developments projects, has mostly been subjected to lower loan value ratios (LVRs), shorter loan terms and higher interest rates. Development and mezzanine funding have also seen a toughening of terms, as well as the imposition of higher requirements for presales and decreased limits on the portion of offshore sales allowed.

Perhaps the problem that’s proven most urgent, dangerous and difficult to solve has been settlement pipeline financing. Although final settlements often only account for 20% of the total sales price, many borrowers, especially foreign investors, have found it impossible to obtain financing of any kind for this portion of the acquisition.

This has created a great deal of nervousness around settlement pipelines, and the possibility that large numbers of buyers would fail to settle their purchases.

While this has not happened and, in fact, groups like Lend Lease have announced higher than anticipated, settlement risk remains a concern in many corners.

New Solutions

The challenges of property developers and investors have attracted the attention of private lenders looking to charge premium rates and fill the gap left by the banks. In addition to established players like Wingate, Balmain and a host of existing property funds, three new groups have stepped into the market.

The first of these new entrants are cashed-up Australian property developers. These players are usually large property companies that are flush from the recent completion of a project.

They tend to be highly localized, only lending into a particular type of development (e.g. only high-rise apartments) and only in one geographic area (e.g. Melbourne CBD). These lenders are often looking for ways to get into the projects they’re funding, with an eye to taking over the development if the borrower is unable to repay the loan.

A more opportunistic group includes purpose-created special investment vehicles, family offices and high-net worth investors. This group is attracted to the high interest rates and strong security positions on offer. These players are more transactional, less strategic and much less established than cashed up developers.

The final group consists of foreign banks, investment funds and high-net worth investors, particularly from the US, China, Singapore and Malaysia. These entities are often connected to property investors from their home country, who have some knowledge of the Australian market and who see an opportunity to further their investment goals by jumping in where the large Australian banks have moved out.

Taken together, these new sources of non-bank lending are beginning to make a substantial impact on Australia’s property lending deficit.

The Event

The huge interest in non-bank lending motivated Basis Point to organize a Non-Bank Lending Conference on September 22. As part of the conference, there will be a “matchmaking” service that pairs up developers and investors with non-bank lenders. The response we’ve gotten so far has been remarkable.

So far, nine non-bank lenders have expressed interest in joining the matchmaking process. These lenders include an Asian multifamily office, a global hedge fund with offices in Australia, two foreign banks, a Chinese non-bank lender, and four Australian property funds.

On the other side, we’ve been approached by a number of borrowers and already have two projects in front of lenders for consideration.

Given this early traction, Basis Point anticipates that this will be its most successful event to date.

By CT Johnson, General Manager, Basis Point, ctjohnson@basispoint.com.au

Aus-China Non-Bank Lending Conference, 22 Sept 2016 | Westin, Grand Ballroom, Sydney Click here

NSW Strata Law Change -opportunities for site acquisitions from the 75% majority rule, when fairness meets fortunes,28 Sept 2016, Sydney Click here