Our latest briefing note discusses the Chinese impact on the Australian housing market.

Meanwhile, there are only 3 weeks remaining before our Significant Investor Visa / Chinese in Australia lunch-seminar, 3 May. Our first, second and third generation Chinese-Australian leaders, representing significant family and philanthropic wealth, will discuss their social integration & investment in Australia.

Please click here for information. The event is sponsored by Arowana International and One Investment Group, with leading firms taking corporate tables of 10, while individual tickets are also available. 200-300 executives are expected.

- With regards to the Chinese impact on Australia’s housing market, this ‘touch-point’ barely existed seven years ago.

- Fast forward to 2016, and Chinese-backed developers bought 38% of Australian residential development sites by value that year, according to Knight Frank.

- These site purchases means more housing supply from Chinese developers should be coming. This will be in addition to their apartment projects already completed or in the pipeline, as the many cranes dotting the skylines of SydMel show.

- Meanwhile, FIRB-restricted overseas Chinese bought around 21% of dwellings in SydMel according to Credit Suisse citing state government stamp duty data. NAB surveys indicated a range of 10% to 20% share over the past few years.

- The relationship between Chinese-backed developers and their distribution channels to mainland Chinese buyers has been critical in boosting their presence in Australia. Developers have de-risked their projects knowing that 20%+ (and in many cases much higher percentages) could be sold via their Chinese distribution channels.

- However, this distribution/de-risking channel is now petering out, not just in Australia but globally, due to tighter controls on Chinese capital outflows.

- Take for example, Country Garden’s US$100 billion, 160,000 dwelling, 30-year Forest City development in Johor, Malaysia, just across from Singapore. Last month, the developer closed all Forest City sales offices in China due to the crackdown on capital outflows. It had sold 17,000 units so far, 70% to mainland Chinese buyers, while resale unit prices in the Johor region are down 10%, according to local media.

- We expect to see similar disruption globally for developers as their Chinese distribution channels are hit by tighter capital controls. This is now compounded by APRA, RBA and ASIC clamping down on mortgage lending by Australian banks.

- However, Australia’s non-bank lending sector has been filling this funding gap, which will soften (but not entirely reduce) the impact locally.

- Anecdotally, individual P2P lending has also stepped in. (Where an Australian resident with a line of credit with a local bank, has drawn down that loan to lend to a foreign buyer on a 70% LVR, using the new apartment as security, earning 9% interest vs 5% cost of borrowing from the bank, for 1 -2 years). Usually the individual lender and borrower are known to each other or have been introduced by a ‘trusted intermediary’.

- We’re not sure how big this individual P2P lending activity is, but it may partially explain the surge in investor loans in recent months. (The uncertainty will come when the loan matures in 1-2 years…the assumption being the foreign buyer will have secured long-term financing by then)

- This Chinese capital shortage comes at a time of heightened political and social commentary about Australia’s housing affordability and whether or not SydMelBris prices are peaking.

- Vancouver, Hong Kong and Singapore also have similar debates but the outcomes vary. Singapore’s house prices have been declining for 3.5 years, Hong Kong prices are booming again to record levels while Vancouver prices look to be falling from all time peaks. Each of these cities introduced significant new taxes and duties to slow down foreign buying.

- The varying outcomes for these 3 cities show there are a multitude of factors that impacts on housing.

- These factors have been covered in the media but a summary is below, with a few additions of my own.

- Population growth, accentuated by interstate migration of construction-related workers in SydMel’s property and infrastructure projects. (Just as the mining boom attracted workers to Perth and regional mining towns which resulted in house price booms and a subsequent crash when the mining boom ended)

- Rental vacancy rates are still hovering at around 2% in SydMel, despite continued supply of new apartments. Population growth is soaking up supply, although substantially more supply is coming this year.

- Growing international student and tourist numbers are also absorbing supply, while a pipeline of purpose-build student accommodation projects and hotels are yet to have impact.

- What percentage of supply is being used as AirBnB holiday lets, or used by the owner as their holiday home, (is Sydney becoming the equivalent of a French Rivera holiday town for the global rich?) or is simply left vacant as booming capital values more than compensates for the difficulties of renting a property for a net ~2.5% yield.

- Sydney market has been under-supplied due to low levels of dwelling construction in the mid 2000s.

- Capital gains and negative gearing tax benefits for residents (but not offshore buyers). New foreign buyer stamp duty surcharges imposed last year.

- Chinese offshore buyers viewing Australian prices as cheap relative to top tier Chinese city prices. (although arguably Chinese prices are again at bubble levels with net rental yields at ~ 1%, while cost of funds are 5%. A net loss of 4% per year has been offset by strong capital growth so far.

- Government measures to cool Chinese prices have failed, due in part to large capital pools in China that cannot now leave, and few investment alternatives apart from property as the funds industry is not well regulated, and uncertainties continue over China’s potentially volatile boom/bust stock market.

- Rising animal spirits (mania) fed by news of 17-19% capital appreciation in SydMel in the past year.

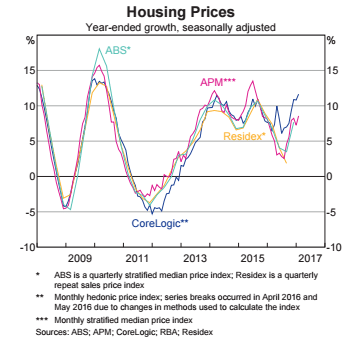

- But there is a wide variation in the calculation of price gains. See RBA chart. Which one is correct but media reporting will nearly always focus on the largest statistic, being the most interesting.

- What is the impact of rezoning in the calculation of house price indexes particularly as Sydney has seen significant rezoning? E.g. 25+ houses in Castle Hill sold for 5 times median price in area as a single development site. Will this lift the price index yet does not actually reflect price changes on properties outside the rezoned area?

- Impact of timing of how price indexes are calculated. E.g. some indexes are based on the time of settlement, not exchange of contract. So OTP apartments bought 2 years ago in the ‘boom days’ are only now used in the price index as they settle today. Is the OTP market a material factor in the price calculation?

- Media reporting can play a crucial role in creating emotion and a sense of fear of missing out (FOMO) leading to even more desperate buying. ASX’s bi-survey of shareholders show 38% of direct share investors rely on friends and family to make investment decisions, while 32% rely on media commentary. These are the 2 largest sources of investment advice and since friends and family will also read media commentary, one could argue that the media influence should rise by 12% (38% x 32%) to equate to 44%!